Bitcoin is hard to understand because it involves different fields of knowledge: economics, technology, philosophy and incentives. I will try my best to explain Bitcoin in just a few bullet points. Perhaps I can awake your curiousity. I will also provide resources to deepen your knowledge.

First of all, let's talk economics. How do currencies like the dollar and euro compare with Bitcoin?

Inflation

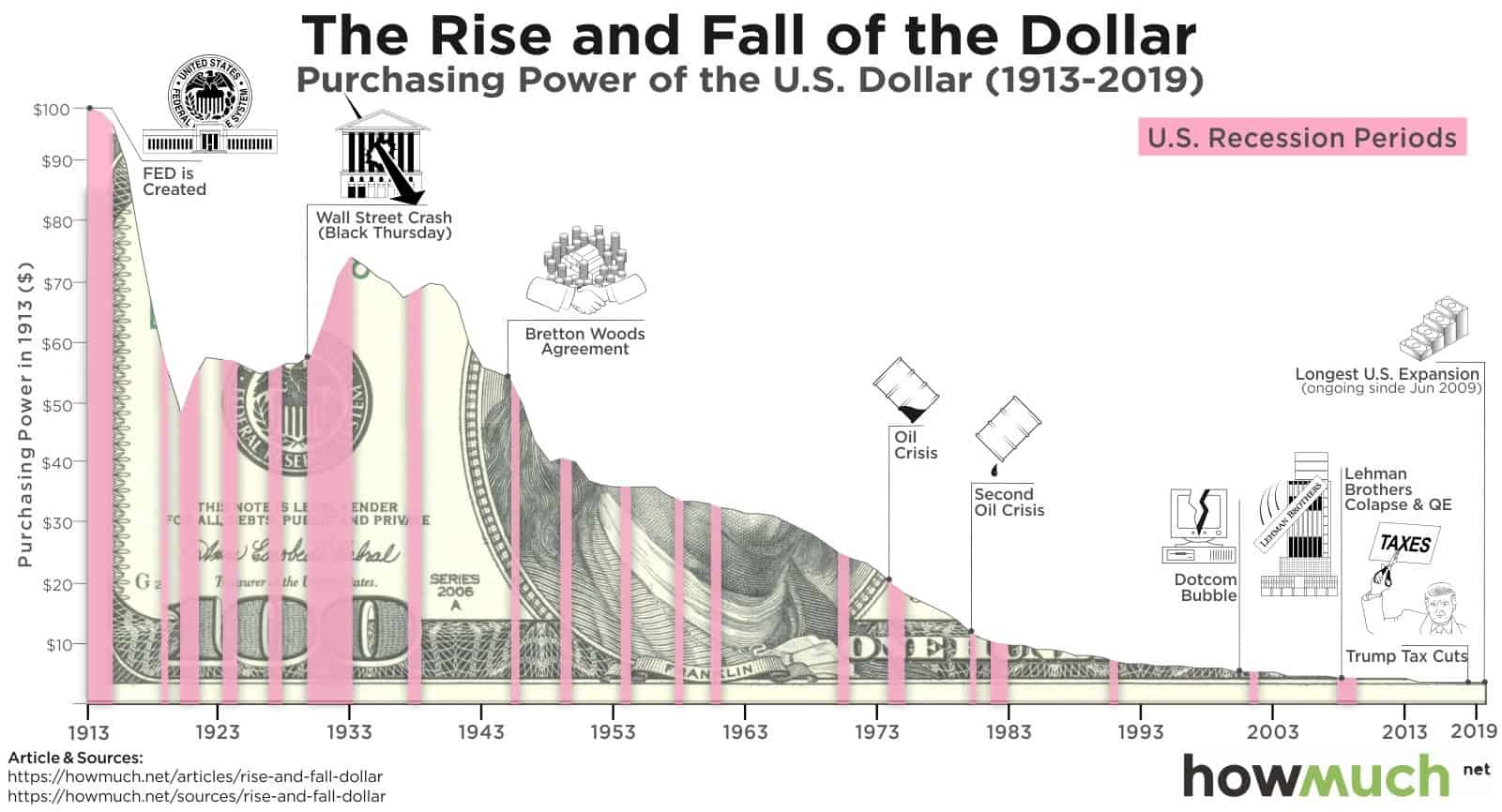

$100 in 1913 would be worth today only $3.87. Over the course of 100 years the dollar has lost 96.13% of its value [1].

While the purchasing power of the dollar has fluctuated since 1913, it has never surpassed the purchasing power it had in 1913.

Understanding why inflation happens is a bit complex. But to summarize: central banks print money at a more or less steady rate. However, during periods of conflict or epidemics, this money creation accelerates significantly. As a result, people's savings lose value.

From the Gold Standard to Fiat money

During the economic depression of the 1930s, countries entered a loop. They would devalue their currency (to promote exports) and adopt protectionist measures (to limit imports). In doing so, they worsened the crisis by deterring international trade.

The USA, and 43 other countries recognized this negative cycle and, in 1944, signed the Bretton Woods Agreement [2], a new international monetary system in which:

-

the dollar became the central currency and the only one convertible to gold ($35 per ounce).

-

all other currencies had a fixed exchange rate against the dollar but were not directly convertible to gold (they first had to be converted to dollars, then to gold).

The system worked well for some years but eventually, both the USA and the other countries began to break the agreement. 1) The USA started printing more dollars than those that they could back up with its gold reserves. 2) Some of the other 43 countries purposely devalued their currency in order to boost exports to the USA, thus causing a trading surplus. The US deficit increased and the dollar came under pressure, leading to the system's collapse.

In 1965, France under President Charles de Gaulle grew suspicious about the system and demanded that the USA convert France's dollar reserves into gold.

Following in France's footsteps, other countries started to request that the USA exchange its dollars back into gold. In 1971, US President Richard Nixon put an end to the dollar's convertibility to gold.

Bitcoin vs. Fiat Currency

As we have seen, since President Nixon detached the dollar from gold in 1971, fiat currencies are no longer convertible to gold. Therefore, they are no longer backed by anything. You can no longer go to a bank and exchange your money for gold.

As a result, fiat currencies are just paper notes. Central banks can print as many as they wish, thus making your money worth less and less.

In other words, fiat money has no intrinsic value as it is no longer backed by anything. Its value relies upon the state's authority. If you don't pay your taxes, you will get into trouble.

People often say Bitcoin is not based on anything. Nor is a fiat currency! Does Bitcoin or fiat currencies have any intrinsic value? The answer is that neither do.

So why would I invest in Bitcoin if it has no intrinsic value? Well, in the same way that fiat money is backed by the state's authority, Bitcoin is backed by electricity. Maintaining the network requires an enormous amount of computational power (hashrate) to mine blocks. It is this electrity that gives Bitcoin its "intrinsic" value. In other words, we are transforming the energy of the physical world into value in the digital world [3].

We've covered some economics. Let's consider the technology and incentives behind Bitcoin.

The Basics of Bitcoin technology

Bitcoin is both a network and a currency. Bitcoin (with an uppercase 'B') refers to the network and bitcoin (lowercase 'b') refers to the currency.

The Bitcoin network is built upon Maths and code. It relies both on technology and incentives, which work in a synergic way [4].

When Bitcoin was created, there were two key challenges to overcome in order to build a peer-to-peer electronic cash system. These challenges are:

- The double spending problem.

- The trusted third party problem.

The double spending problem presents the challenge of preventing User A from transferring the same single coin to both User B and User C at the same time. Traditional currencies don't face this challenge because physical notes cannot be used twice and digital fiat money is controlled by the state.

To address the double spending problem, one of the solutions is to introduce a trusted third party. This leads to the second challenge, namely the trusted third party problem. Any third party can be hacked or act maliciously.

Bitcoin overcomes this problem by being a peer-to-peer network that doesn't require trust. Since the same participants are responsible for both 1) mining new blocks and 2) verifying that the Bitcoin protocol is being followed and that no one is abusing the system.

How Bitcoin Works: Blockchain, Miners and Nodes

This technology involves:

- Blockchain: a series of blocks in which each new block contains the hash of the previous one, thus forming a chain. It acts as a timestamp server. Since we can't trust any individual or organization to provide time for Bitcoin, the network creates its own time through the blockchain.

- Miners are computers that rapidly perform calculations to solve complex cryptographic puzzles. When a block is successfully mined, the miner receives a reward. At the same time, the block is added to the blockchain and all the transactions within it are confirmed.

- Nodes are computers that store the full copy of the blockchain and help validate transactions and blocks. To keep Bitcoin decentralized and secure, it's essential that anyone can run a node. Nodes can freely leave and rejoin the network and then accept the longest proof-of-work chain as evidence of what has happened whilst they were away.

- Encryption: to mine a block, miners must find a number (nonce) which, when passed through the SHA-256 hashing algorithm, produces a hash that is lower than the target value set by the Bitcoin network. Since there is no shortcut to find this nonce, miners use brute force, trying as many possible combinations as fast as possible, until one miner solves the puzzle and earns the right to add the block and claim the reward.

Incentives

Incentives are well-aligned in Bitcoin. I can't cover everything in this post but to name a few:

- Bitcoin is scarce: this serves two purposes: 1) its fixed supply makes it deflationary. Consecuently, long-term savings in bitcoin are likely to hold or increase its value. 2) It helps the network gain traction so people are incentivized to enter as soon as possible. A network with no users is as useful as a library with no books!

- Diminishing block rewards: every 210,000 blocks (≈4 years), the reward for mining a block is halved. This creates a strong incentive to adopt Bitcoin as early as possible since new issuance becomes scarcer with each halving period.

- Bitcoin's supply is pre-established: everyone knows that the total amount of bitcoins is limited to 21 million. It's also known the rate at which they will be mined. In the first halving period, each block mined rewards the miner 50 bitcoins; in the second halving period, the reward is 25 bitcoins and so on. Around the year 2140, the reward will be reduced to zero [5].

- Miner's rewards: Nowadays, miners earn mostly from the block reward. In 2025, that is to say the fourth halving period, the reward is 3.125 BTC per block. As the reward decreases, miners will rely more on fees from the users who want to add transactions to the blockchain. Once the block reward reaches zero, they will depend solely on these fees.

- Why run a node? Unlike miners, nodes don't grant rewards. However, to ensure that your bitcoins are safe, it's important to protect the network. There are currently around 23,000 public nodes but as long as even just one node is running, the network can work. The Bitcoin network only depends on Maths, the internet, and the existence of people with good-will. There is a clear incentive for those who have significant capital in bitcoin to buy a node, thus protecting the network and their wealth.

- Why only 21 million bitcoins? The whole point of bitcoin is that its supply is limited, thus protecting the value of your investment from inflation. Can Bitcoin code be changed to increase the quantity of bitcoins to exceed 21 million? The answer is technically yes. Bitcoin receives updates constantly; these are called BIPs (Bitcoin Improvement Proposals) [6]. However, realistically, this is not going to happen. BIPs are accepted or rejected based on community consensus and increasing the supply of bitcoins would dilute the wealth of its holders. Therefore, regarding incentives, those most involved in the network are the least interested in increasing the total supply of bitcoins.

Common doubts [7]

But Bitcoin is Volatile:

Bitcoin's volatility is one of the most common criticisms and with justification. However, the price is extrinsic to Bitcoin. This volatility just means that the market still doesn't know the value of Bitcoin. As time goes on, its volatility decreases. In fact, volatility is good, since Bitcoin is not a company, nor does it have a marketing department to promote it. If it weren't for the volatility, Bitcoin would still be worth $1.

The famous term HODL originated from a 2013 Reddit post uploaded by a drunk person. He said that he was a terrible trader and was unable to make a profit by predicting the rise or fall in the price of bitcoin. But he realized that if he ignored the short-term swings and just held the asset, the traders would then not be able to profit from him.

There's a lot to learn about Bitcoin; therefore there is a big asymmetry of knowledge between those who understand it and those who don't. This causes people to feel envious when they miss opportunities to make a profit and to panic-sell when the price falls. This happens as a result of a lack of understanding of the asset. It's important to bear in mind the long-term value of Bitcoin and not let our emotions cloud our vision in the short term.

Why Bitcoin and not Crypto?

There's a fundamental flaw in grouping everything together under the term "crypto". This would imply that other crypto assets compete with Bitcoin. In reality, most of them don't even intend to. As I have already said in this post, one of the most important virtues of Bitcoin is that there is no third party involvement. If you have a network that has been running on its own for over a decade, why would you choose a cheaper alternative that could be manipulated by any person or company at any given time?

Other crypto projects don't aim to become global monetary systems; rather, they aim to be entrepreneurial projects or, even worse, neolottery. Remember that if you think that a bitcoin is too expensive, you can always buy sats (satoshis, the smallest unit of bitcoin).

Resources

Recommended videos:

- Michael Saylor at BTCPrague 2024: The 21 Rules of Bitcoin.

- Jack Mallers at BTCPrague 2024: The Intrinsic Value of Bitcoin and Proof of Work.

- Jack Mallers at BTCPrague 2025: About the struggles of the current generation, the impact of inflation, and the revolution of Bitcoin.

Recommended book:

- Filosofía de Bitcoin (Spanish) by Álvaro D. Maria: A

highlyrecommended book that explains how Bitcoin changes the way we relate to money, how it redefines the concept of property ownership, and how it can change the political system that we live in. Read the preview (The full book is available on PlanetadeLibros).

Mentioned sources:

- Inflation - [1]

- Bretton Woods Agreement - [2]

- Jack Mallers at BTCPrague 2024: The Intrinsic Value of Bitcoin and Proof of Work - [3]

- Bitcoin Whitepaper - [4]

- Bitcoin halvings explained: The reward per block at each halving - [5]

- Bitcoin Improvement Proposals - [6]

- Preview: La Filosofía de Bitcoin - [7]